Alaska Ui Handbook

Unlike most other states where ui tax is paid only by the employer in alaska employees pay a share of the tax and it is the employers responsibility to withhold the employees share.

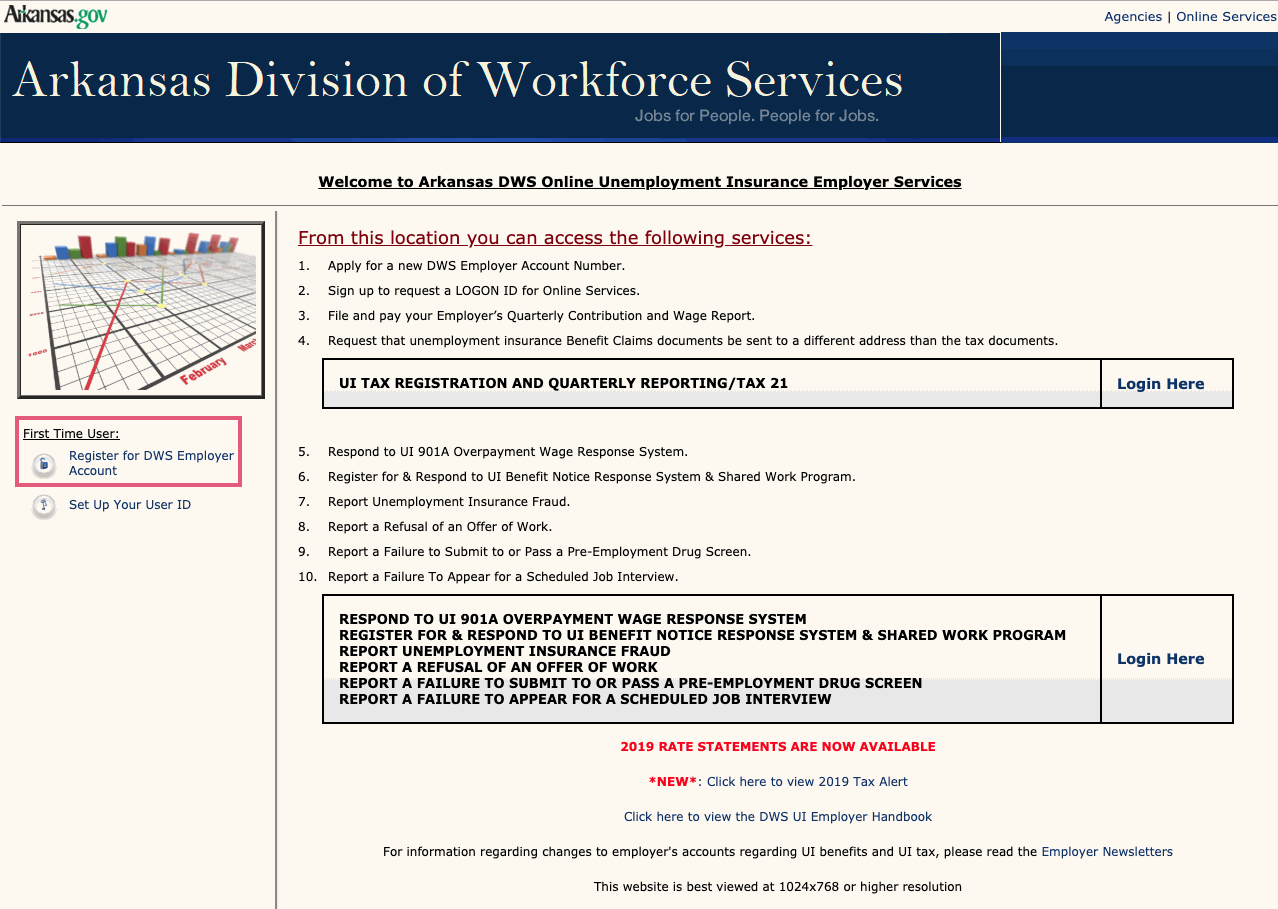

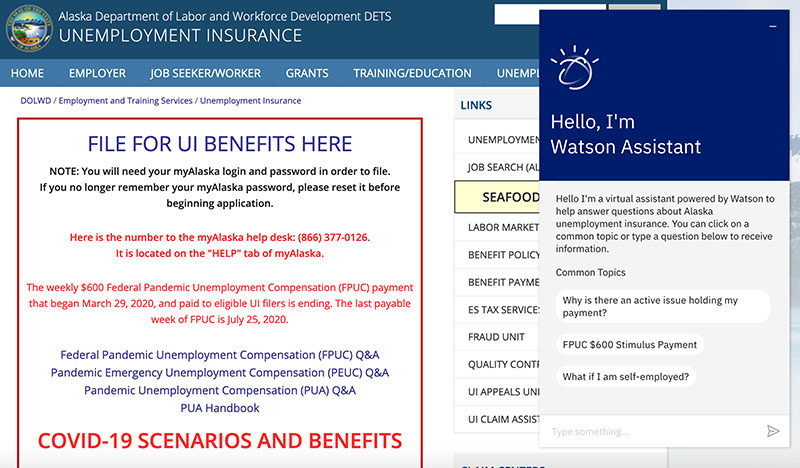

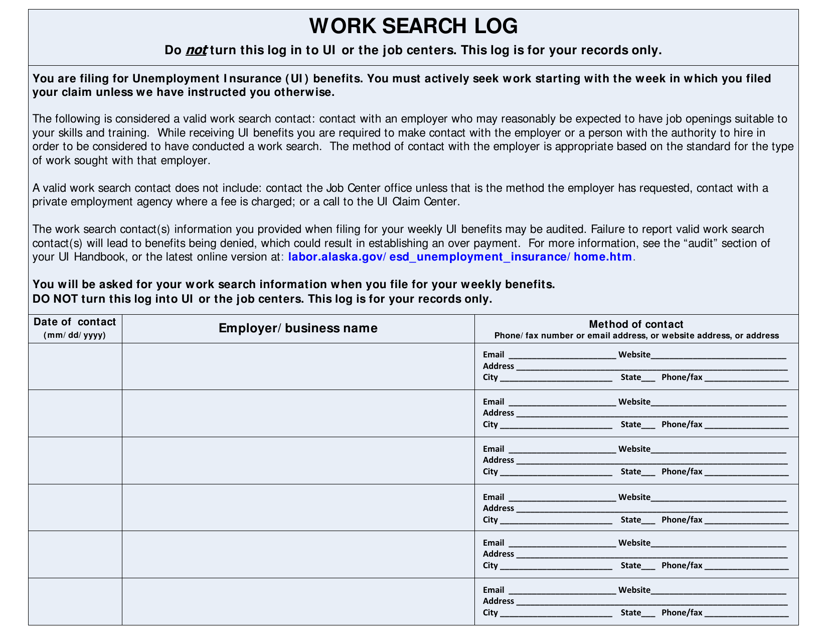

Alaska ui handbook. You will be required to repay the benefits. It is primarily responsible for providing assistance and information to employers concerning the ui tax program and for the collection of ui taxes. A total gross income of at least 2500 earned over two calendar quarters of your base period.

Continuing eligibility for each week claimed. Also alaska often refers to employment security tax est rather than unemployment insurance tax. Wage credits from an employer that is subject to unemployment insurance laws covered employment.

Employers can obtain information about the ui tax program and collection of ui taxes in the alaska employer tax handbook pdf. Here are the basic rules for alaskas ui tax. It is primarily responsible for providing assistance and information to employers concerning the ui tax program and for the collection of ui taxes.

The unemployment insurance ui tax section of the division of employment and training services dets is located in the alaska department of labor and workforce development akdol. The unemployment insurance ui tax section of the division of employment and training services dets is located in the alaska department of labor and workforce development akdol. To file tax reports submit tax payments view account balances and payment history visit employment security tax online and click on on line employer services tired of filling out paper ui forms.