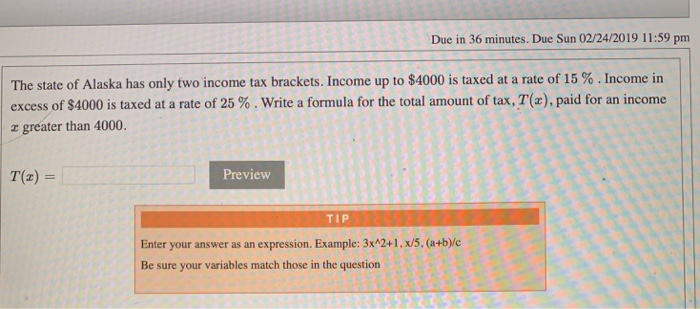

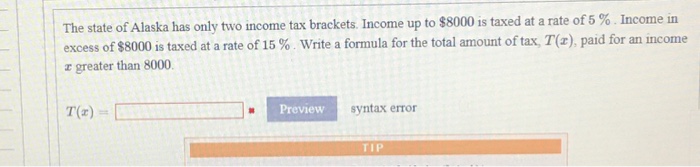

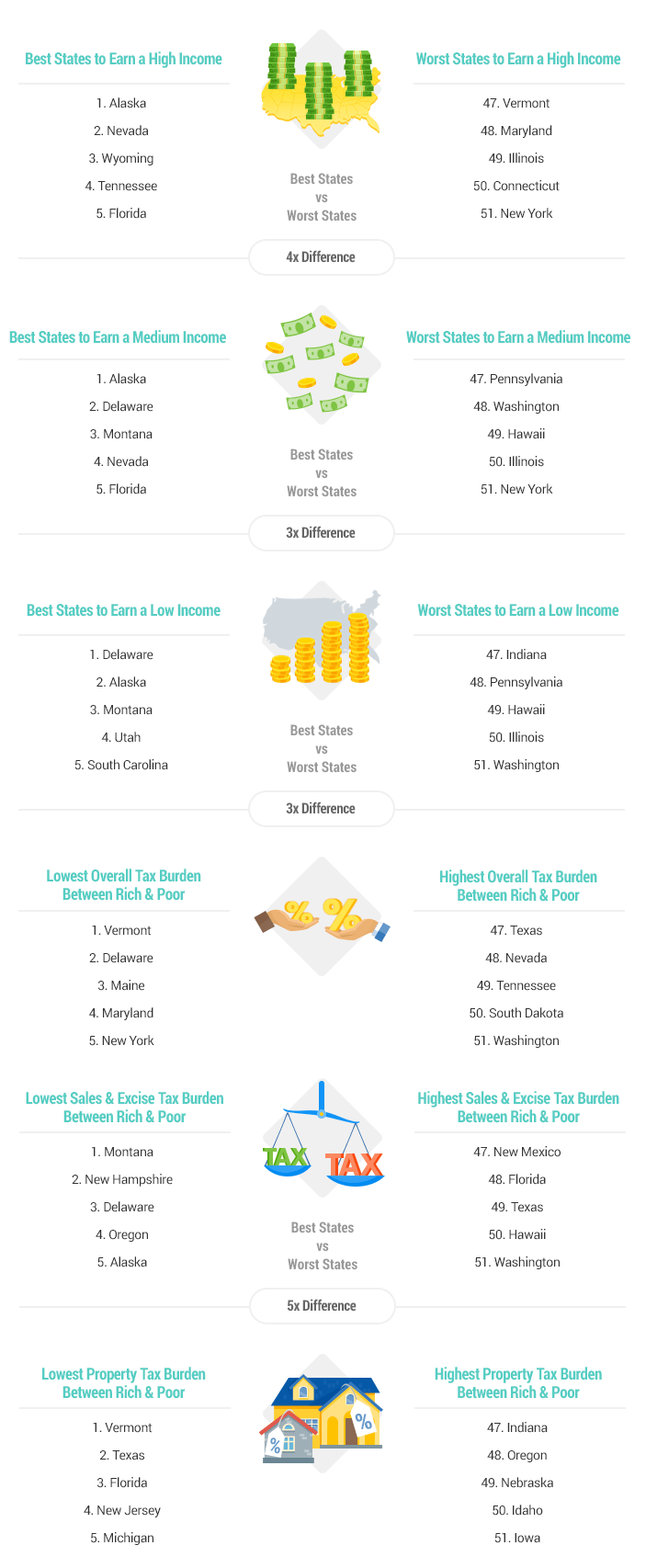

Alaska Income Tax Brackets

Alaska tax rates and resources for taxes on personal income sales property estate and more.

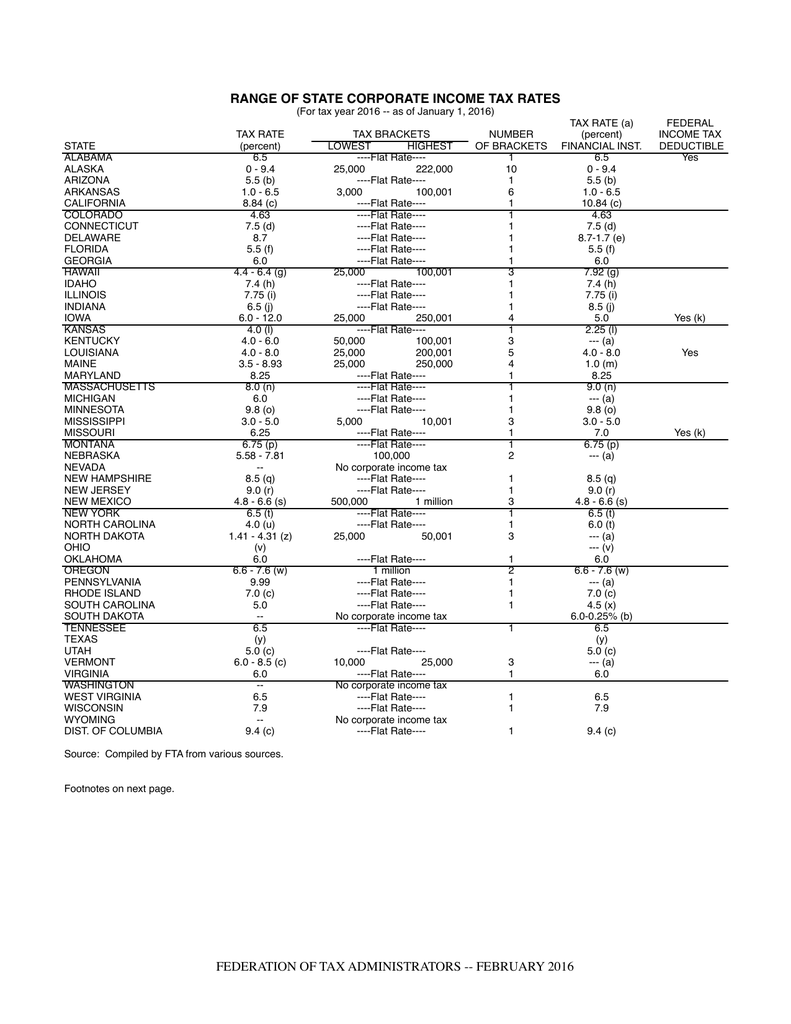

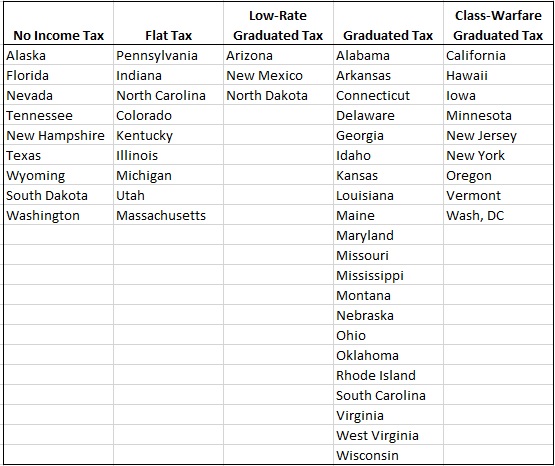

Alaska income tax brackets. Detailed alaska state income tax rates and brackets are available on this page. In a progressive individual or corporate income tax system rates rise as income increases. Alaska collects a state corporate income tax at a maximum marginal tax rate of 9400 spread across ten tax brackets.

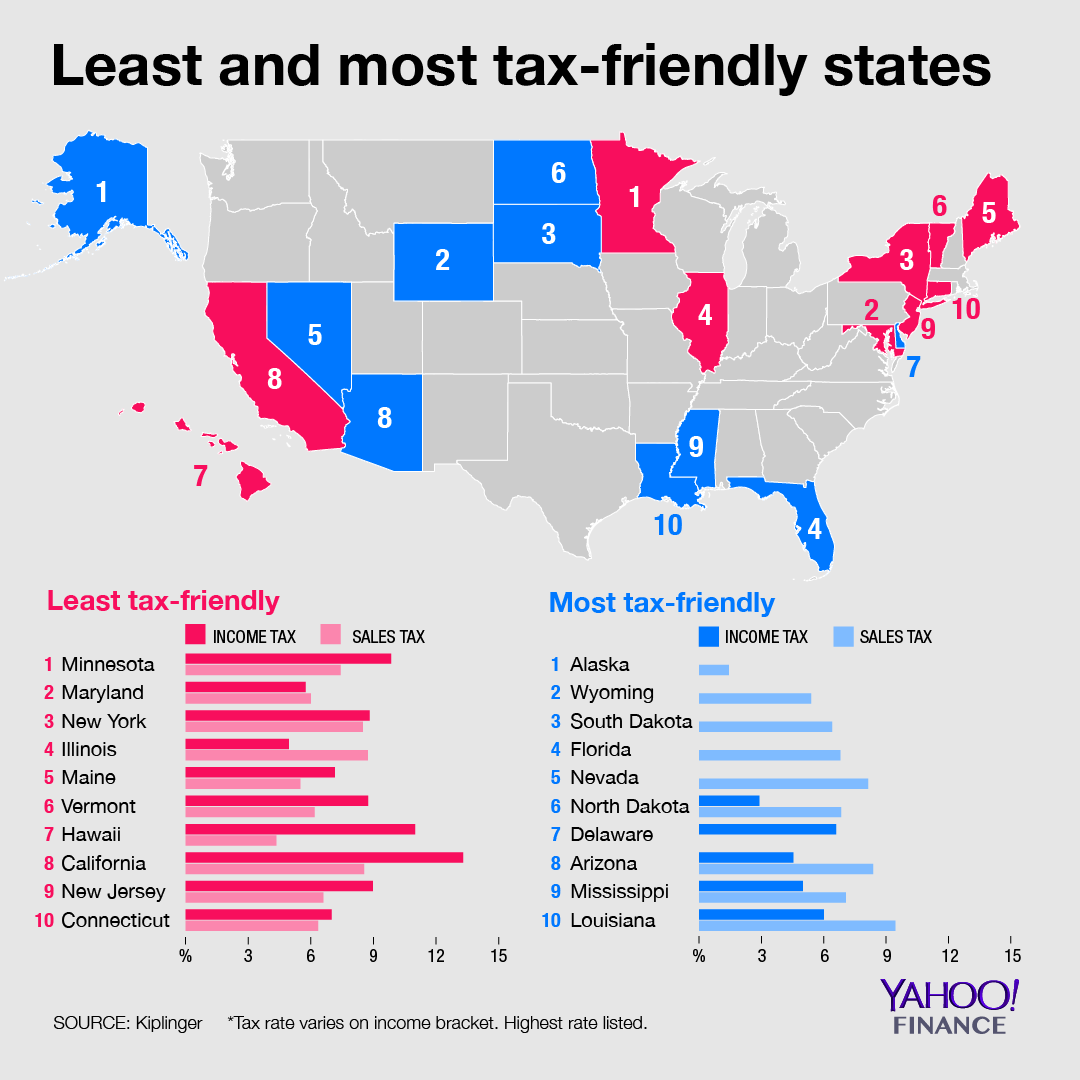

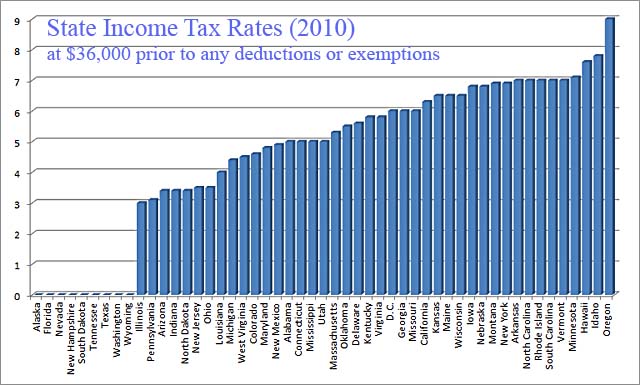

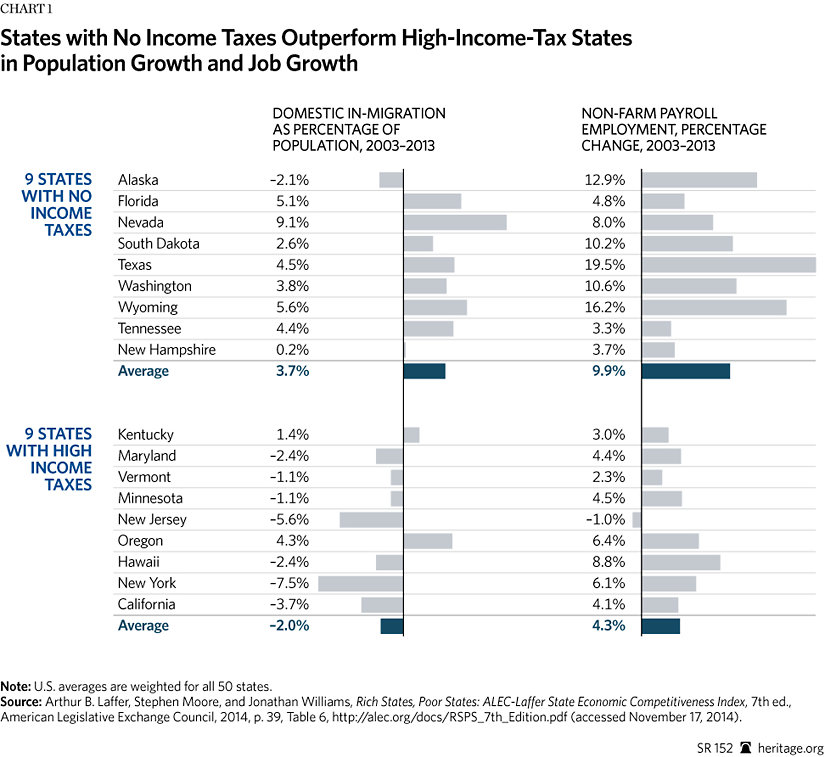

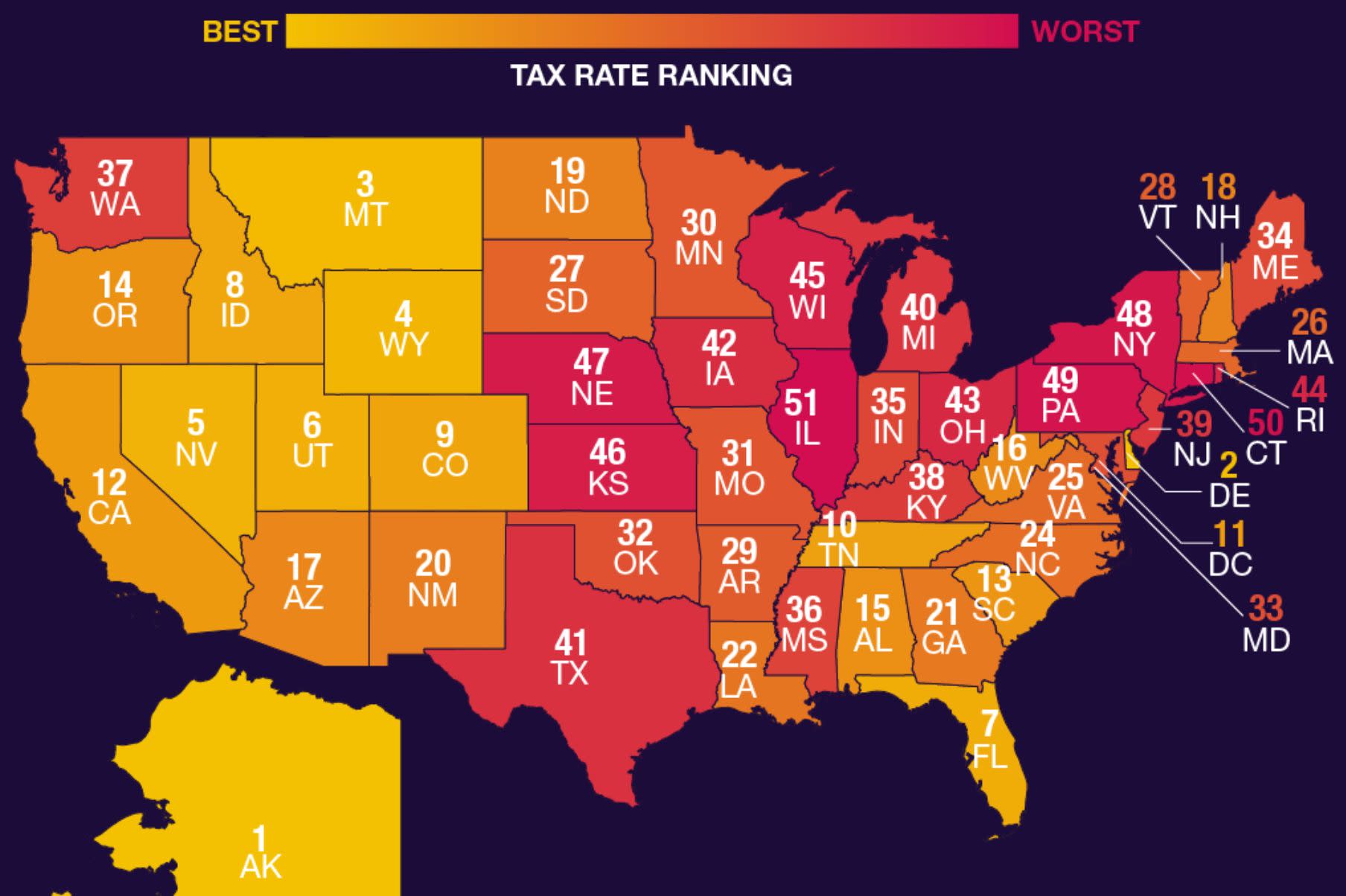

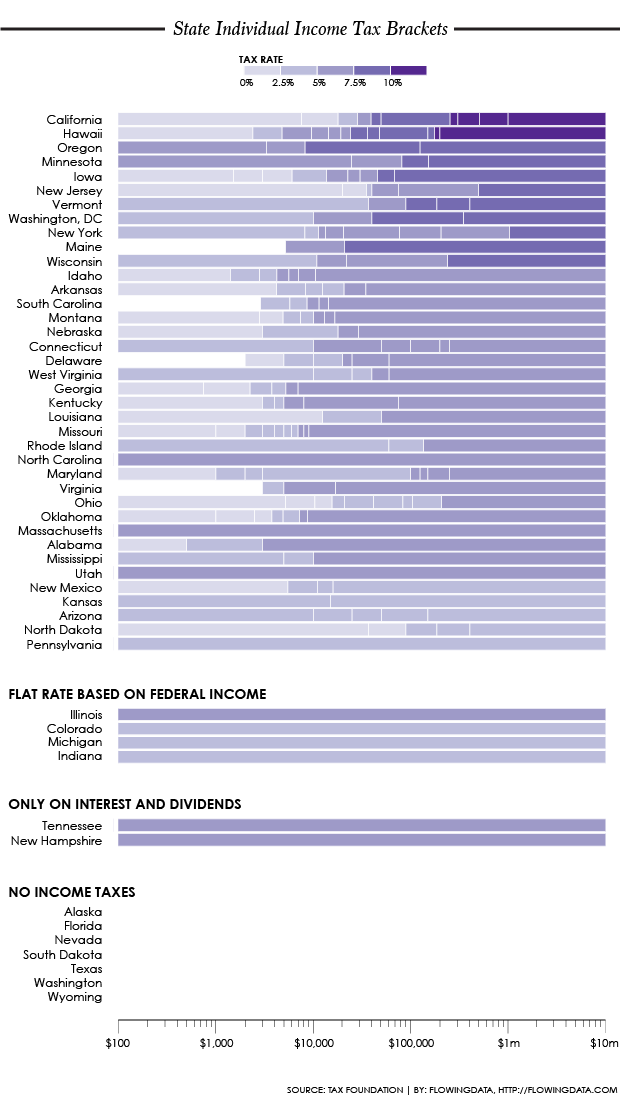

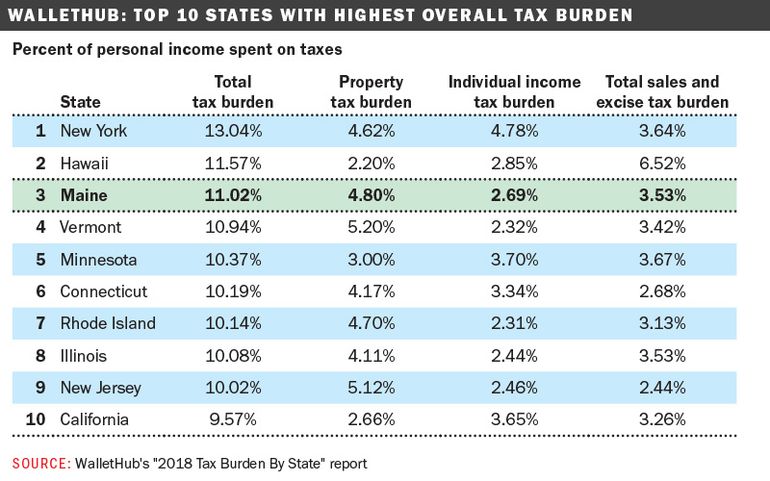

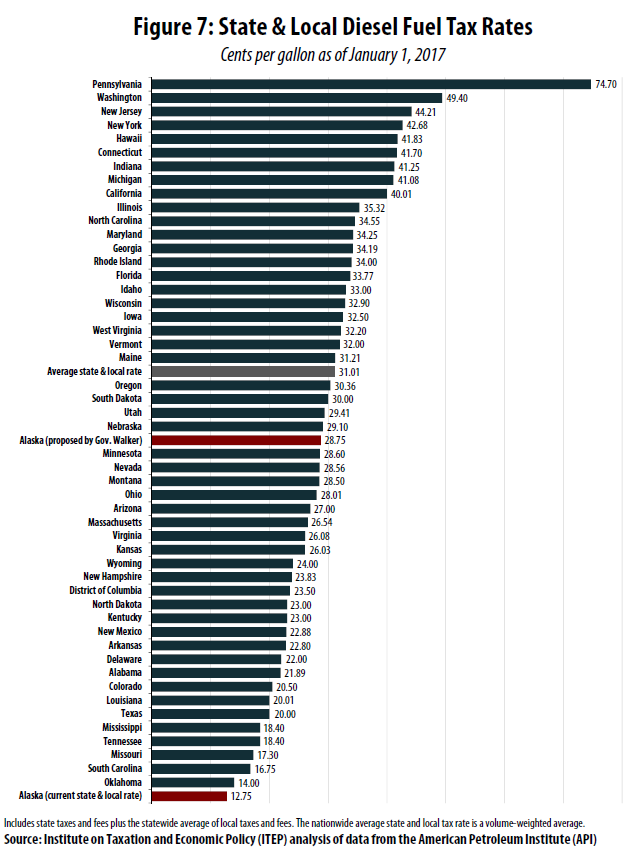

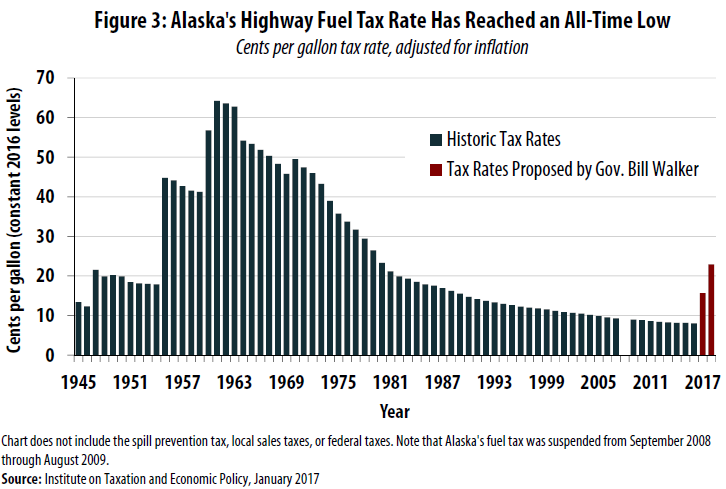

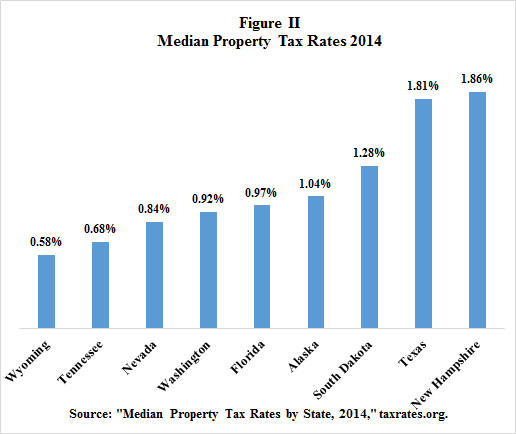

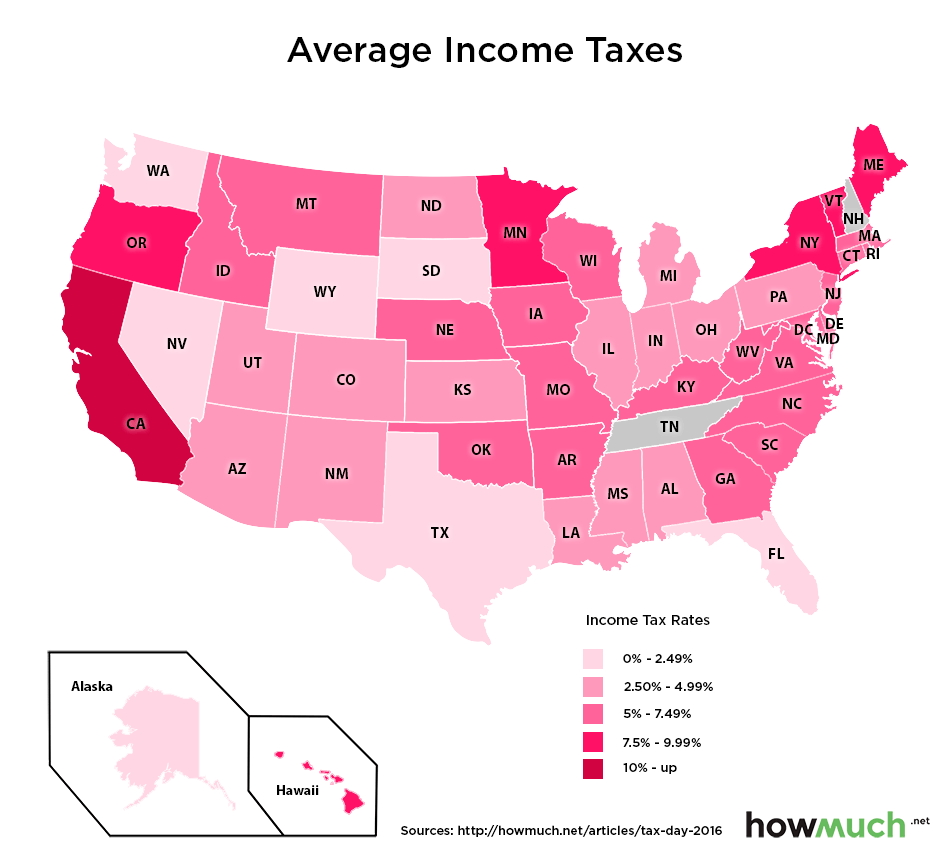

Americas largest and northernmost state also has the lowest taxes in the nation as there are no statewide income or sales taxes in alaska. The federal corporate income tax system is flat. Each state has its own taxation system usually a combination of income sales and property taxes.

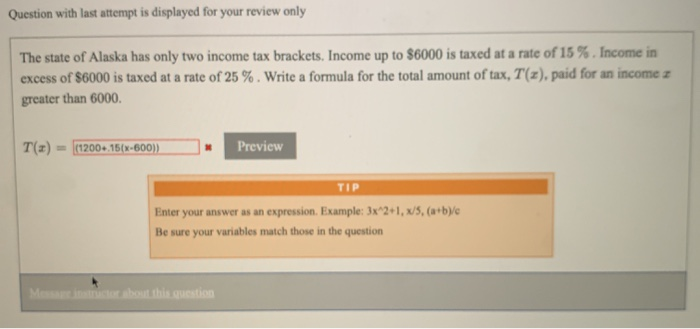

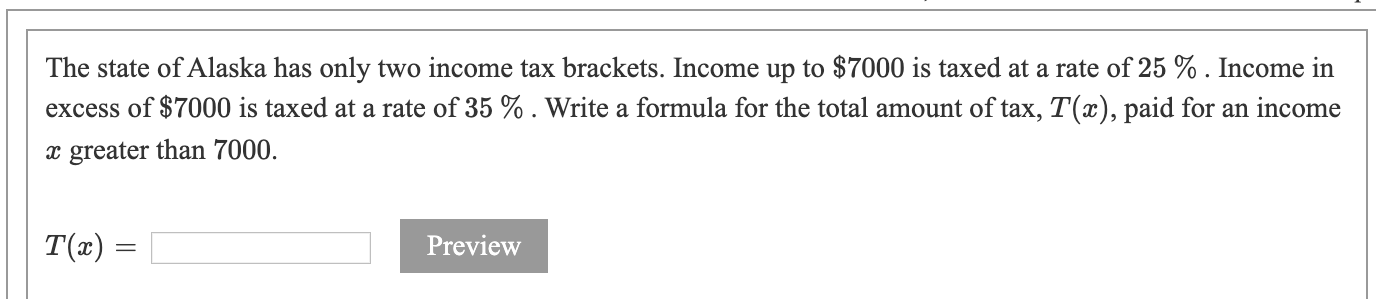

There are seven federal individual income tax brackets. The 0 rate applies to taxable income of 25000 and below while the 94 rate applies to taxable income of 222000 and over. Alaska state income tax rate table for the 2019 2020 filing season has zero income tax brackets with an ak tax rate of 0 for single married filing jointly married filing separately and head of household statuses.

Alaska honors the federal filing extensions. Alaska has no state level income taxes although the federal income taxstill applies to income earned by alaska residents. The alaska income tax has one tax bracket with a maximum marginal income tax of 000 as of 2020.

Alaska state income tax rate for 2019 is 0 because alaska does not collect a personal income tax. Corporations file returns annually with the alaska return due 30 days after the federal tax return is due. Alaskas maximum marginal corporate income tax rate is the 5th highest in the united states ranking directly below illinois 9500.

Alaska taxes corporate income at graduated rates ranging from 0 to 94 divided over 10 tax brackets. Alaska income tax rate 2019 2020. A tax bracket is the range of incomes taxed at given rates which typically differ depending on filing status.

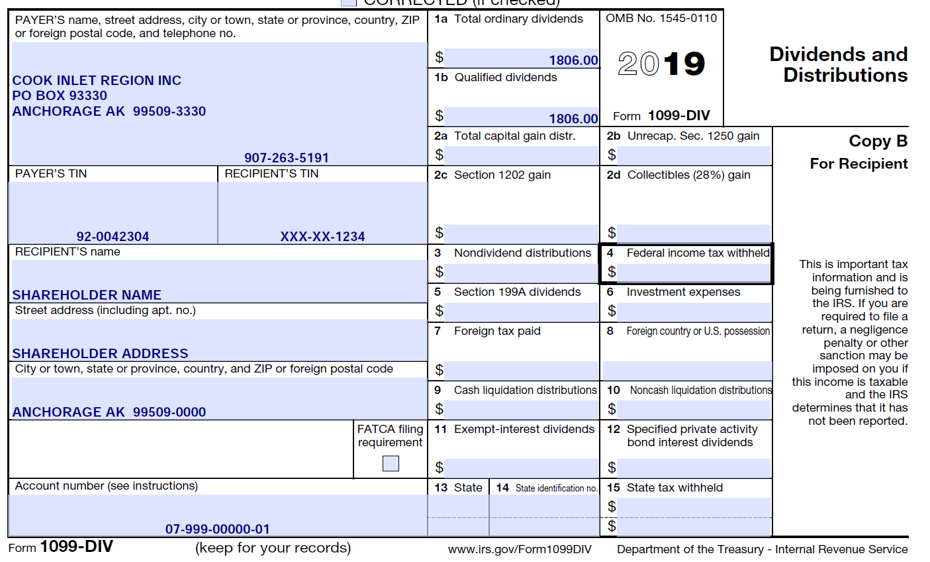

Residents do need to file a federal tax return though no state paperwork is requiredresidents also receive annual checks from the state just for living there through the permanent fund dividend. Both alaskas tax brackets and the associated tax rates have not been changed since at least 2001.

/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3.png)

2.png)

/states-without-an-income-tax-36d1d404657e490db7bb3be36a9d0619.png)