Alaska Homestead Act 2016

250 thousand sq mi of public land or nearly 10 percent of the total area of the united states was given away free to 16 million homesteaders.

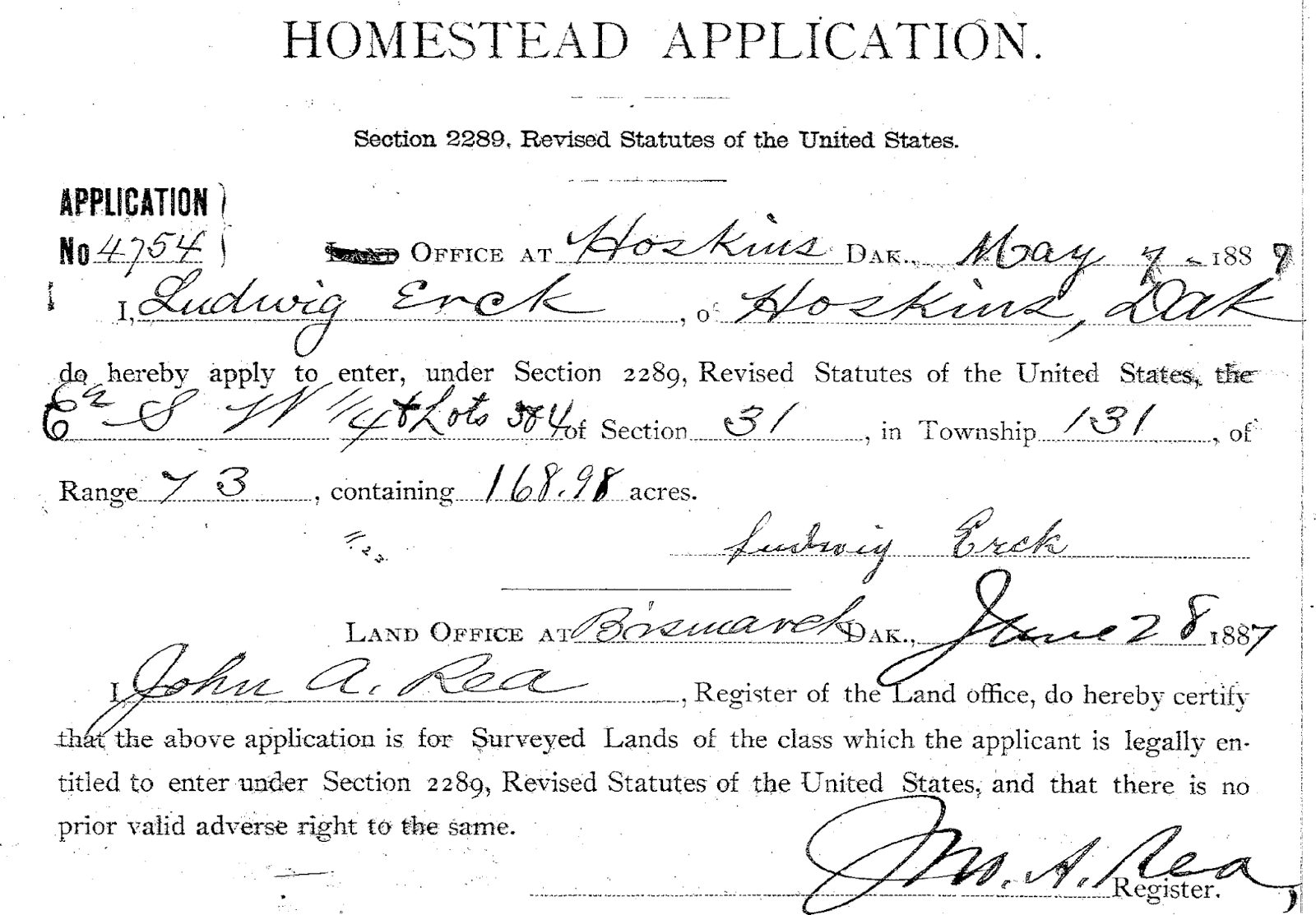

Alaska homestead act 2016. On that day all homestead laws were repealed nationwide however a 10 year extension was allowed in alaska since it was a new state with fewer settlers. Even though the homestead act was enacted in 1862 the history of homesteads in alaska began in the 1890s. The homestead acts were several laws in the united states by which an applicant could acquire ownership of government land or the public domain typically called a homesteadin all more than 160 million acres 650 thousand km 2.

Here youll find specific information about the homestead exemption in alaska. A an individual is entitled to an exemption as a homestead of the individuals interest in property in this state used as the principal residence of the individual or the dependents of the individual but the value of the homestead exemption may not exceed 54000. The last time anyone could file any type of homestead claim in alaska was on october 20 1986.

Alaskas homestead exemption applies to ones primary residence not a vacation home or second property. Even with the free land being offered it has always been a bit slow due to poor weather and soils. 1 the alaska homestead exemption is notdoubled for a husband and wife filing a joint petition.

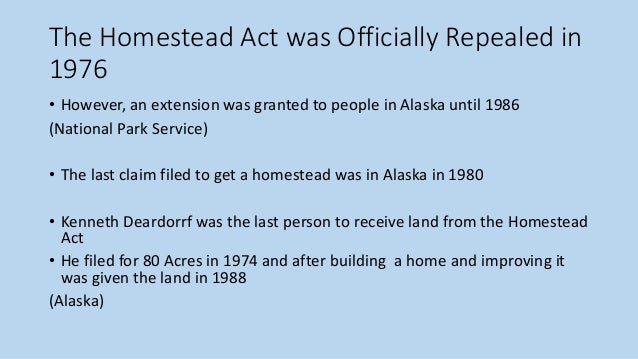

Most of the. Unlike most states alaska does not impose an acreage limit for homestead exemptions. The homestead act was finally repealed in 1976 but a provision of the repeal allowed for homesteading to continue in alaska until 1986.

The state of alaska currently has no homesteading program for its lands. If a debtor is married and the spouse does not join in the bankruptcy petition the debtor can only take one half 12 of the total homestead exemption amount. To date over 3000 homesteaders have taken land in alaska.

If you file for bankruptcy in alaska the homestead exemption protects up to 70200 worth of equity in your home. The last homestead to be awarded under the provisions of the homestead act was in 1988. Homesteading ended on all federal lands on october 21 1986.

The state allows homestead exemptions of up to 72900 but does not allow married couples to double that amount. In 2012 the state made some state lands available for. The owner of that land kenneth deardorff originally filed for his 80 acre parcel on the stony river in alaska in 1974.

Alaska although very beautiful can be a rugged place to live off the land. Federal land policy and management act of 1976. For information about how the homestead exemption works in both chapter 7 and chapter 13 bankruptcy see the homestead exemption in bankruptcy.